Scholarship For International Students In 2025/2026

Scholarship For International Students In 2025/2026 🎓 Introduction to Global Scholarship Opportunities If you’re dreaming of studying abroad…

Plumber Job Opportunities in Australia for Skilled Immigrants: Visa Sponsorship Details In 2025/2026

Plumber Job Opportunities in Australia for Skilled Immigrants: Visa Sponsorship Details In 2025/2026 Introduction to Plumbing Careers in…

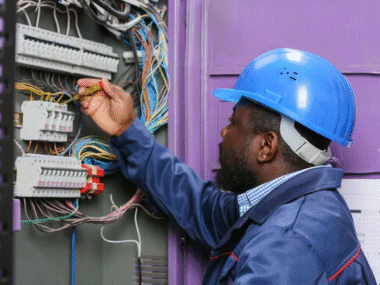

Electrical Engineering Jobs in the USA for International Professionals In 2025/2026

Electrical Engineering Jobs in the USA for International Professionals In 2025/2026 Introduction Are you an electrical engineer dreaming…

Top Study Abroad Scholarships for International Students (2025–2026 Intake)

Top Study Abroad Scholarships for International Students (2025–2026 Intake) Introduction Dreaming of studying abroad but worried about the…

USA Job Grant & Visa Sponsorship Opportunities in 2025/2026: Your Gateway to the American Dream!

Introduction Have you ever caught yourself dreaming about working in the U.S., living in a bustling city or…